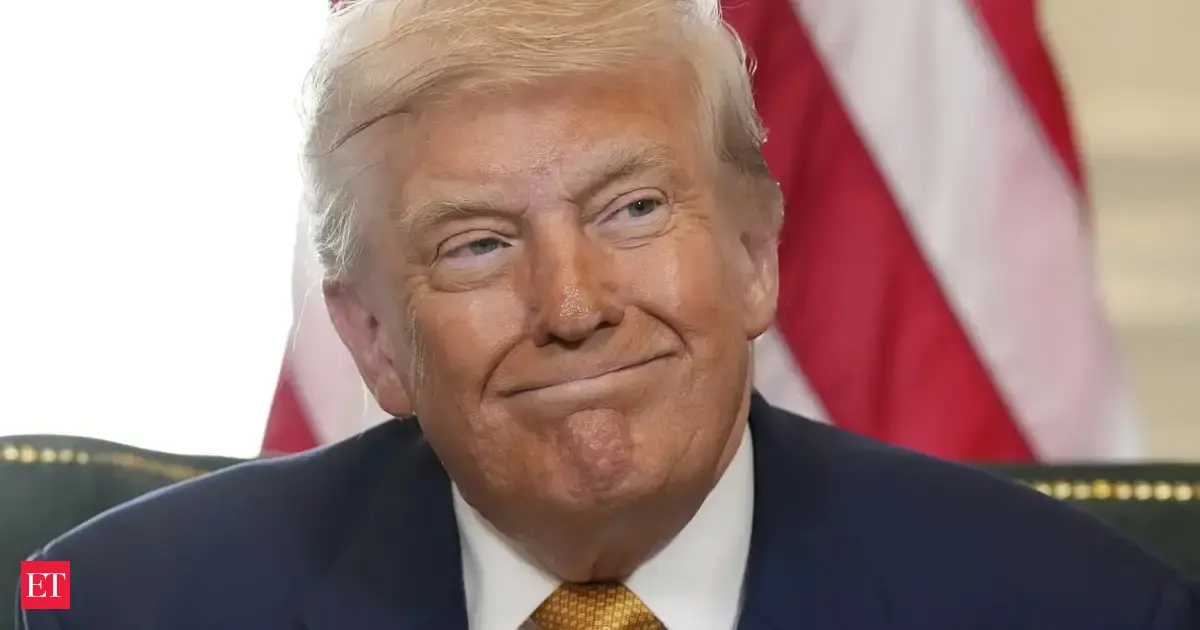

President Donald Trump’s sudden 25% tariffs on Indian goods have triggered economic alarm in New Delhi, with bilateral trade relations facing their most severe test in decades. The August 1 deadline threatens to upend $54 billion in annual trade, forcing PM Modi to balance economic damage control with strategic realignments.

Textiles, pharmaceuticals and engineering sectors—accounting for nearly half of India’s US exports—could face immediate 15-30% price disadvantages overnight. Analysts warn the measures may push India deeper into Russian and Chinese economic orbits, undermining Washington’s Indo-Pacific strategy.

With Trump calling the tariffs “reciprocal justice” while campaigning in Midwestern swing states, the move appears equal parts economic policy and election-year theater—at potentially devastating cost to Indian exporters.

- Trump’s proposed 25% tariffs on Indian goods risk collapsing key export sectors like textiles and pharmaceuticals, with historical data showing a 12% decline in textile exports after similar 2018 tariffs.

- The August 1 deadline pressures PM Modi to negotiate as trade tensions threaten to push India closer to strategic rivals Russia and China, potentially destabilizing US partnerships in the region.

- Analysts suggest the tariffs align with Trump’s 2024 campaign rhetoric, prioritizing political symbolism over economic benefits while risking higher costs for US consumers of Indian goods.

- Indian exporters may explore legal loopholes like transshipment through third countries, but enhanced US Customs monitoring since 2020 makes evasion riskier.

- The timing following Modi’s UK visit underscores the transactional nature of US-India relations, despite Trump calling India a “good friend.”

Donald Trump’s 25% Tariffs on India: Immediate Economic Shockwaves

President Donald Trump’s sudden imposition of 25% tariffs on Indian exports has created immediate turmoil in New Delhi’s economic circles. The August 1 deadline gives Indian businesses barely two weeks to prepare for what analysts describe as the most significant trade disruption since India’s economic liberalization in 1991.

The tariffs specifically target India’s key export sectors:

- Textiles (22% of US-bound exports)

- Pharmaceuticals (18% of US-bound exports)

- Engineering goods (15% of US-bound exports)

Early estimates suggest the tariffs could erase $8-12 billion from India’s annual exports to the United States. The Confederation of Indian Industry warns that nearly 1.2 million jobs could be at risk, primarily in labor-intensive sectors already struggling with pandemic recovery.

Textile Sector Braces for Existential Threat

The Indian textile industry stands as the most vulnerable sector facing Trump’s tariffs. With profit margins typically ranging between 3-7%, the 25% duty effectively prices most Indian textiles out of the American market.

| Category | Current Export Value | Projected Loss |

|---|---|---|

| Apparel | $4.2 billion | 35-40% |

| Home Textiles | $3.1 billion | 25-30% |

| Technical Textiles | $1.4 billion | 15-20% |

Geopolitical Fallout: Pushing India Toward Russia and China?

The timing of Trump’s tariff decision could prove strategically costly for Washington. Coming just months after the Biden administration’s efforts to strengthen the US-India partnership through the Quad alliance, the trade measures risk undermining years of diplomatic work.

Moscow and Beijing appear ready to capitalize on the rift:

- Russia has offered discounted energy deals

- China proposes fast-tracking border dispute resolution

- Both nations promise easier market access for Indian goods

The Pharmaceutical Paradox

America’s reliance on Indian generic drugs creates a curious dynamic in the pharmaceutical sector. While the tariffs nominally cover drug exports, analysts suspect the US may implement special exemptions for critical medicines.

Can Indian Businesses Survive the Tariff Shock?

Export-oriented Indian companies face three potential survival strategies:

- Price absorption: Eating the tariff cost temporarily

- Market diversification: Finding alternative export destinations

- Value addition: Moving up the product value chain

Historical Context: Comparing Trump’s 2018 and 2025 Tariff Wars

The current India tariffs mirror Trump’s 2018 trade actions against China, but with crucial differences:

| Aspect | 2018 China Tariffs | 2025 India Tariffs |

|---|---|---|

| Initial Rate | 25% | 25% |

| Target Sector Breadth | Wide-ranging | Selective |

| Retaliation Capacity | Significant | Limited |

The Political Calculus Behind Trump’s Move

Several factors appear to motivate Trump’s tariff timing:

- 2024 election campaign positioning

- Distraction from domestic legal issues

- Demonstration of “tough negotiator” image

Long-Term Consequences for US-India Relations

Beyond immediate economic impacts, the tariffs risk causing enduring damage to strategic cooperation:

- Defense technology transfer hesitation

- Reduced Indian enthusiasm for Quad partnership

- Acceleration of rupee settlement mechanisms bypassing USD

Comments